How to Reduce DSO: 7 Strategies for Better Accounts Receivable Management

You’ve run the numbers, looked at previous metrics, and realized that your DSO is higher than it should be. You may be seeing the impact on your day-to-day cash flow, or you could simply be trying to get ahead of future problems. Either way, you’re looking to reduce your DSO – and the following strategies can help you get there.

Step 1: Set Realistic DSO Targets

In a perfect world, customers would pay right away. But, the reality is, most companies need several days – if not several weeks – to collect and verify their invoices, get approvals, and schedule payments.

To decide on a target DSO, you’ll want to consider the average for your industry, as well as how long it typically takes your company to convert receivables into cash. (This article takes a deeper look at using your DSO as a KPI.)

If your current days sales outstanding is 90+, you won’t be able to get to 30 days overnight. A more reasonable initial goal is an improvement of 10-15 percent. That means reducing your DSO to 77-81 days if you’re currently at 90 days, or getting to 51-54 days if you’re currently at 60. Once you’ve met this initial target, you can re-evaluate your cash flow and decide if you still need to improve.

Step 2: Review Your Payment Terms

A typical guideline for accounts receivable management: your DSO should be within 15-20 percent of your stated payment terms. Once you’ve figured out how much you need to reduce your days sales outstanding, you can re-evaluate your payment terms to make sure they align.

When looking at your payment terms, you’ll want to look at more than just the period of time that your buyer has to pay the amount that’s due. You can also look at:

- Early payment incentives (such as a 1 or 2 percent discount for paying within 10 or 15 days)

- Late payment penalties

- How you’re asking to be paid (electronic options let you access payments right away, instead of waiting several days for a check to come in the mail – although some of your customers might not be willing to adopt new technologies)

Step 3: Get Better at Credit Risk Management

Your payment terms go hand in hand with your credit practices – which are equally important to consider when you need to reduce your DSO. If you’re too lenient, you take on a greater financial risk – but if you’re too strict, you may be missing out on potential business.

When you review your credit policy, be sure to consider:

- Your company’s overall financial risk tolerances

- What criteria customers need to meet to be approved for credit

- How you plan to process each application (e.g. using a third-party company for a B2B credit check, or requesting more references from new customers)

- How you plan to resolve delinquent accounts (from preliminary communications through collections)

You’ll also want to consider whether credit policy changes could actually increase your DSO, rather than reduce it. For instance, if you add more paperwork or more extensive credit checks to your process, you’ll likely spend more time on accounts receivable management upfront. However, if the time you spend on this step is less than the amount of time (and money) you’d spend dealing with delinquent accounts, it may be worth the trade-off.

And remember: you don’t have to decline business from customers you deem too risky. Instead, you can consider options like pre-payment, cash on delivery, or a partial up-front deposit.

Step 4: Improve Your Invoicing Practices

Once you know how you plan to reduce your DSO, you’ll need to communicate your new policies very clearly to your customers. That may mean updating your invoice template to put the due date and preferred method of payment front and center.

There’s also the issue of getting delivered to the customer right away. (After all, if your customer hasn’t received an invoice yet, there’s nothing for them to pay!)

If you currently wait for customers to receive their purchases before you send your invoices, you could start sending invoices after each order has shipped. You could also consider emailing your invoices to speed up the process even further.

There’s also the option of automating your invoices, but we’ll get into automation a bit further on.

Step 5: Improve Your Collections Practices

Even though most customers pay on time (and those miss the first deadline do usually follow through in the end), companies still need to have a documented debt recovery policy in place. This ensures that you know what to do in a worst-case scenario (and that you spend as few resources as possible on the process.)

One of the most common customer responses on a collection call is “I never got that invoice, can you send it to me?” Employees then have to get off the phone, reprint the invoice, re-scan it, and re-email it out. Implementing an enterprise content management system can give the user access to the invoice while the customer is on the phone, and the customer can receive the invoice immediately. This allows the AR team an opportunity to come up with a payment plan for the customer right then.

For the most part, one or two friendly reminders are usually enough to get a customer to address an unpaid invoice. (Be sure to keep complete documentation of all your communication attempts – in the event that you do need to send the account to a collections agency, this will make the process smoother.) But, if multiple reminders go unanswered, it may be easiest to turn the account over to the pros. That way, you can go back to focusing on more financially valuable accounts.

Step 6: Increase Visibility

Reducing DSOs is a collaborative effort. Credit managers, financial analysts, and CFOs all have their own role in the process – and they all need real-time information to make more informed decisions.

An unpaid invoice report is a great place to start – but they’ll need to look much deeper to get to the bottom of your high days sales outstanding. Visibility is crucial; your team needs to know which customers are late to pay, whether there’s any correlation with your company’s sales patterns, and whether you’re doing anything internally to hold up the process. If you don’t already have a reporting process in place, consider investing more heavily in a system that’ll let you create a more accurate cash flow forecast.

Step 7: Consider Automation for Effortless Accounts Receivable Management

At the end of the day, managing your receivables is a time-consuming process. Anything you can do to make it easier can have a positive impact on your cash flow.

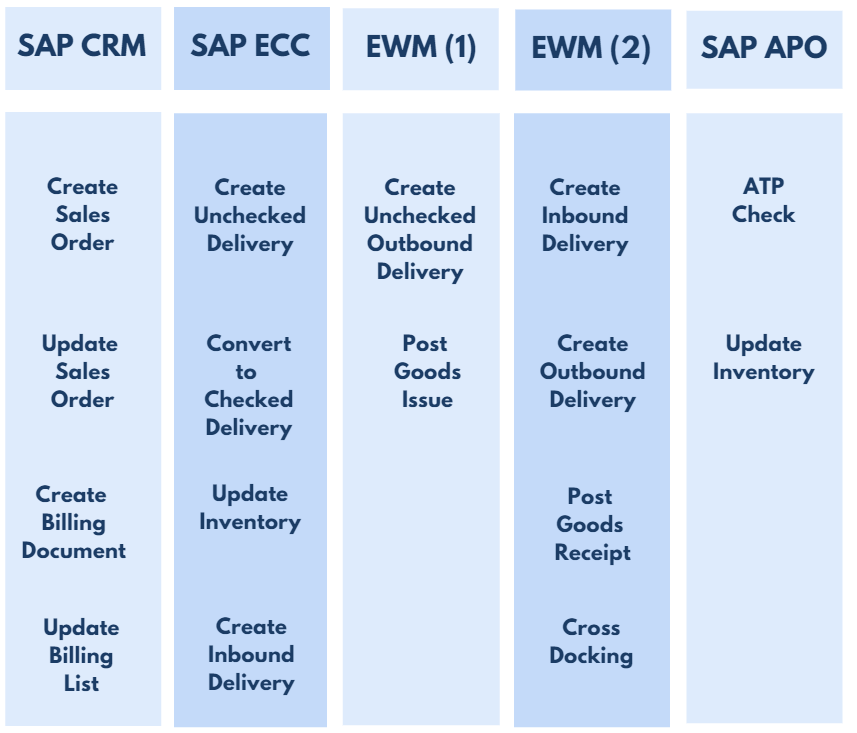

AR automation is one way that you can speed things up. Instead of having an employee create invoices, confirm each company’s billing information, and print and send your paperwork, you can let an automated system handle everything for you by processing documents through programmed workflows.

Companies that automate their order to cash processes are usually able to reduce their DSOs within a few months. Their customers get their invoices faster, don’t have to worry about duplicate charges, and spend less time contacting customer service. Internally, these companies can eliminate repetitive processes and free up their Accounts Receivable team to work on more important projects.

Let IntelliChief Help You Reduce Your DSO and Improve Your Accounts Receivable Performance

Ready to improve your approach to Accounts Receivable management? IntelliChief can help. Our business process optimization team can help you automate your most time-consuming workflows. We’ll recommend ways for you to reduce your DSO, increase your cash flow, and process your receivables with less effort from your team.