Why DSO Is an Important KPI

Learn several ways to measure your Accounts Receivable performance

Learn several ways to measure your Accounts Receivable performance

Companies have quite a few ways to measure their Accounts Receivable performance. One key performance indicator (KPI) that provides particularly valuable insight: your DSO, or days sales outstanding.

A DSO analysis can show you how effectively you’re collecting payment for your products or services, and how that relates to your company’s cash flow. By knowing how many days your sales are held up in receivables, you can evaluate your invoicing practices, credit terms, and financial projections on a more strategic basis.

To calculate your DSO KPI, you’ll first need to pick a reporting period: most companies run reports monthly, quarterly, or yearly. Any shorter of a period, and you’re not getting a large enough sample to accurately reflect your performance.

The typical formula:

The final figure is your days sales outstanding.

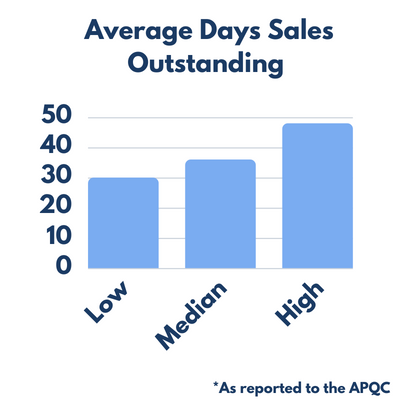

Per an APQC survey published in CFO magazine, the most efficient companies report a DSO of 30 days or less. The longest DSOs were in the 48-day range, while 36 days was the median.

When comparing your DSOs to the average, note that many different things can influence your Accounts Receivable performance. For certain companies, 48 days – the “poorest performance” metric from the APQC study – is actually an excellent DSO for their particular industry.

According to SageWorks, there are a handful of industries for which a DSO of 60+ days is considered average. These include:

To put your DSO into perspective, be sure to consider the average expectations in your industry. If competitors typically have longer payment cycles, yours may very well be on the longer side as well; it could simply be a side effect of your industry’s business model.

On a similar note – the same way that it’s normal for certain industries to have “slow seasons”, it’s also normal for certain companies to have periods when their DSOs are higher than normal. If your current accounts receivable balance includes one or two large orders that are several months old, that can cause your numbers to be skewed.

DSO calculation methods that focus on a 12-month average don’t let you account for periods where your monthly sales are higher (or lower) than the norm. This is why most companies use a monthly (or quarterly) KPI, then compare their current number to the benchmark from the same period in the previous year.

Another thing to keep in mind: some companies choose to offer more lenient terms to larger customers. For example, a major account that provides a larger share of a company’s revenue may be asked to pay within 60 or 90 days, while smaller accounts may be asked to pay more quickly. One or two such accounts can increase the average number of days that your sales go uncollected.

Depending on your invoicing terms, you’ll likely want your DSO to fall within 20 percent of your standard policy. For instance, 36 days should be your maximum target if you request payment from a typical customer within 30 days.

If your DSO KPI is too high, your cash flow will likely suffer. Because you won’t have access to your profits right away, you’ll need to come up with a strategy for covering the costs of overhead while you wait for payment. Plus, the more sales you have to send to a collections agency, the more time (and money!) your company ends up wasting.

There are several ways you can improve your days sales outstanding. For instance, you can:

For more in-depth strategies, check out our in-depth guide to reducing your DSO.

Of course, DSOs are just one financial KPI for you to monitor. You can also take into account the number of days that pass from an invoice’s due date to the date it’s actually paid (your average days delinquent), the number of invoices you collected compared to the number of invoices you sent out (your collection effectiveness index), and the net value of your credit sales as they compare to your average accounts receivable balance (your accounts receivable turnover ratio).

If your cash flow is typically strong, there’s no need to worry – even if your DSO is on the high side for your industry or company history. But, if you’re consistently running into issues, it may be time to consider some changes.

At IntelliChief, we can help. Our Accounts Receivable solutions make it possible to invoice customers more quickly, reduce lead times, and gain more visibility into your entire order-to-cash cycle.