How to Conduct a Remote Audit

Most audits are conducted on-site, not because it’s practical or convenient but because it has become customary over the years. Since the dawn of accounting, in-person audits have become a facet of doing business that we begrudgingly accept. In fact, most companies conduct internal audits to be 100 percent certain that they are maintaining compliance with SOX, SOC 1 (Type 1 and Type 2), SEC Rule 17, and other external and internal compliance regulations. Although it’s worked reasonably well, technology now permits businesses to conduct audits remotely, which means greater flexibility for business, reduced auditing costs, and greater peace of mind. But how do you conduct a remote audit? And how do you know if your business is prepared for remote accounting audits?

What Technology Do You Need to Conduct a Remote Audit?

For companies interested in conducting remote audits, it is important to recognize that technology is the key to unlock this useful capability. Enterprise Content Management (ECM) systems that combine Document Management, Mobile Content Management, and Workflow Automation are ideal for driving remote auditing capabilities. ECM facilitates the digitization of all enterprise documents, which leads to expanded options for dealing with documentation both in and out of the office. Here’s how it works:

- Enterprise Content Management: a single, integrated platform that connects with your existing Enterprise Resource Planning (ERP) system and provides the framework for the various technologies that make remote audits possible.

- Document Management: technology that digitizes documentation and provides a secure, centralized repository from which all documents can be accessed, reviewed, and processed by approved users.

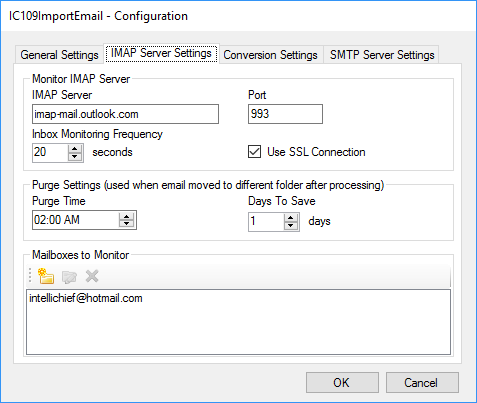

- Mobile Content Management: technology that facilitates access to your organization’s digital repository by providing remote access to mobile devices. Mobile Content Management not only allows users in the field to process documents without returning to the office but also permits auditors to collect and review documents remotely for faster, less expensive audits.

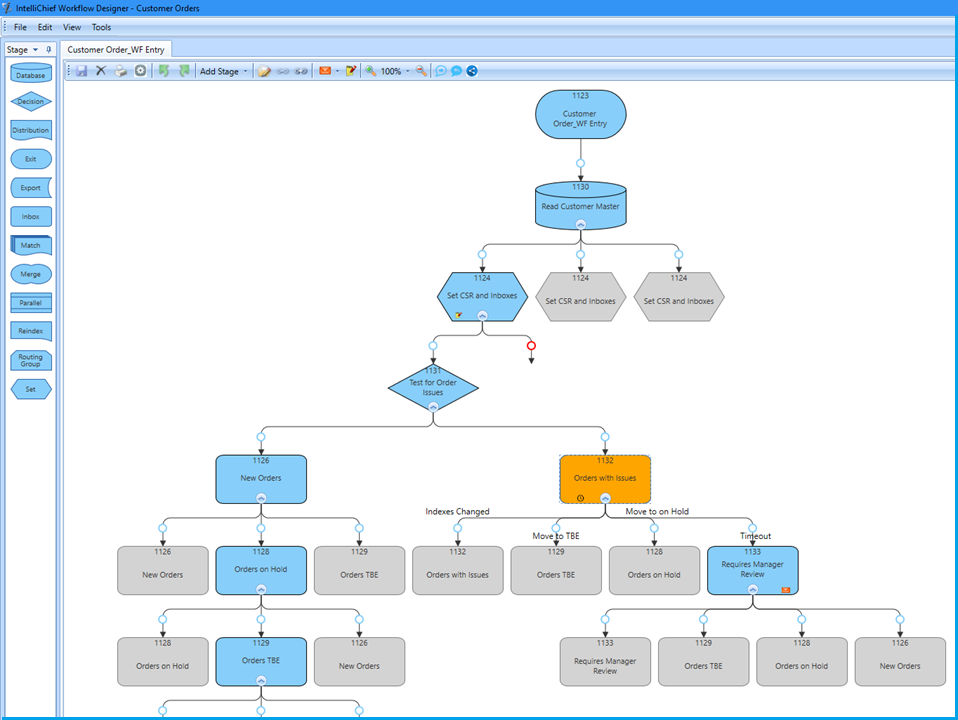

- Workflow Automation: advanced automation that leverages Robotic Process Automation (RPA) to streamline workflows and automate processes from start to finish. It also helps auditors find what they’re looking for more quickly and allows organizations to automate records retention using RPA-powered policies.

Are Remote Audits Right for Your Business?

ECM permits remote access, allowing approved users to source documentation from throughout your organization. It also allows businesses to create and control access by auditors using the same ECM system. In other words, you can provide temporary credentials to an auditor, allowing them to access the documents they require (and only those documents). This capability is ideal for enterprises that handle a large volume of documentation, such as invoices, sales orders, packing slips, and even onboarding forms.

The other benefit of using an ECM system to perform a remote audit is that it doesn’t limit your businesses to the types of audits it can perform. ECM is designed to be utilized across the enterprise in Accounting, Finance, Legal, Customer Service, Human Resources, and more. These departments often process thousands of documents per month, which creates a significant burden for your auditor if they are tasked with finding documents manually.

What Are the Benefits of Remote Auditing Technologies?

There are many benefits for businesses that conduct remote audits. First and foremost, it makes the process of undergoing an audit simple. Your company provides their auditing firm with an ECM user account with approved permissions that dictate what the auditor can access. Related transactional documentation is also readily available as long as your ECM system supports digital paper trails. Leading ECM systems operate as a “single source of truth” or SSOT. That means your auditor can find everything they need within a single, integrated system. Other benefits include:

- Provides a central repository with robust search capabilities based on any recorded criteria (i.e., invoice #, vendor name, item #, date, logo, and more)

- Supports centralized access from decentralized locations

- Reduces audit fees

- Accelerates audit completion

- Captures all transactional documentation using automated Optical Character Recognition (OCR) software, ensuring that no documents are ever lost, damaged, or destroyed

- Organizes documentation contiguously.

- Validates and updates information in real-times

- Improves business intelligence with robust analytics capabilities

- Tracks auditor activity and progress

- Guides auditors using plain-text notifications

- Generates reports that are useful for both your organization and the auditor

- Allows your organization’s decision-makers to easily review audit results whether conducted internally or externally

- Facilitates customizable, scalable dashboards that deliver convenient self-service analytics reporting for each audit

- Conducts multiple audits simultaneously from disparate locations

What Happens After You Embrace Remote Auditing Technologies?

Once you start to conduct audits remotely, it doesn’t necessarily mean the end of on-site meetings. These will continue to occur, although much less frequently, and these interactions should be streamlined due to the added organization and file access provided by your ECM system. Collaboration with auditors and your department heads will be accelerated for faster resolutions. The company-firm relationship will remain strong, and perhaps even improve thanks to the added efficiency of ECM.

It’s still important to meet face-to-face every now and then, but in an increasingly digital world, it’s not unrealistic to believe that these types of interactions are already being phased out in favor of meetings conducted over Zoom and other video conferencing platforms. Additionally, auditors are freed from long stints as a company’s on-site guest — something all parties admittedly appreciate. Your auditors will no longer need to travel, billable hours will be reduced, and you will gain greater control over the cost of audits. Your company will, ultimately, avoid audit projects exceeding projected timetables and budgets, resulting in mutual satisfaction in your fiscal relationships.

Needless to say, remote auditing is highly advantageous for all parties. ECM provides the platform to keep it convenient and cost-effective, allowing your organization to focus less on checks and balances and more on future growth.