4 Common Matching Issues for Major ERP Systems

Is there anything more frustrating than footing the bill for a fraudulent or inaccurate invoice? For years, business owners have struggled to give their Accounts Payable (AP) departments the tools they need to prevent invoice processing errors related to manual data entry, duplicate invoices, and faulty exception handling — and it’s starting to take a toll on several industries.

According to Infor, “approximately 0.1% to 0.05% of invoices paid are typically duplicate payments.” In other words, a business that grosses $150 million per year could lose as much as $750,000 to duplicate payments over a five-year period. This “lost” money could have been invested in training, bonuses, infrastructure, and virtually anything else businesses need to succeed. For most businesses, utilizing a 3-way matching process is a reliable way to cut down on matching errors, but it can also lead to additional Accounts Payable challenges.

In theory, a true 3-way matching process matches not only the invoice and purchase order but also its corresponding receiving information, thereby eliminating the chance for duplicate payments and counterfeit invoices. Unfortunately, this process can be a hindrance for businesses that aren’t equipped with the tools to process invoices quickly and accurately. For instance, some enterprise resource planning (ERP) systems require the processor to manually check to ensure that all related documents have been received to approve the 3-way match and complete the AP process. Another common ERP-related issue is a system’s inability to read purchase orders (POs) and receipt tables, rendering automatic voucher creation an impossibility.

IntelliChief, was built to overcome these limitations with unparalleled workflow automation and invoice matching capabilities. Unlock your team’s true potential by eliminating pitfalls in your existing AP process and watch productivity soar as you reduce manual exception handling by as much as 50% or more.

Issue #1: Workflow-Restrictive Implementation

Too often we find that enterprise-class software wants your business to play by their rules. Whether you’ve been in business for one, ten, or one hundred years, your existing business processes should be respected and considered whenever new technology is incorporated into your workflow. A lack of flexibility is one of the major detractors of point solutions that aim to address a single issue. You can’t apply their technology to other departments or workflows, and you must mold your existing processes to “play nice” with their system.

IntelliChief is unique because it is an enterprise content management (ECM) platform that integrates directly with your ERP system and can be configured to your exact business processes. Whether you utilize a 2-, 3-, or 4-way matching process, IntelliChief can be configured accordingly to help you reduce lag time and AP errors.

Issue #2: Queued Matching

How do you streamline a process that grinds to a halt every time something unfamiliar enters your queue? On top of that, how do you ensure that easily processed documents aren’t trapped behind a wall of exceptions? Realistically, utilizing any sort of queue in your process will lead to slowdowns and additional Accounts Payable challenges. For example, if your team members must enter an invoice to see if the receiving has been completed, it’s only a matter of time before your entire system is bogged down.

As an Infor Solution Partner and Oracle Gold Partner, IntelliChief matches invoices in real-time to help businesses avoid late fees while capitalizing on opportunities for early payment discounts. Exceptions are routed into workflow and automatically processed once the system has enough confidence in a match or recognizes that it’s within your tolerances. Any exceptions that fail the confidence test are then routed to a user for manual approval, leaving only your most pressing (and real) exceptions to be handled by your AP department.

Issue #3: No Unit of Measure Conversion Capabilities

Reducing the number of exceptions in your AP process is a surefire way to increase productivity. Whenever your processors are forced to deal with an exception, they are committing extra time to a particular transaction regardless of its value. Whether a transaction is worth $1 or $1 million, every additional second your team requires to process it is being siphoned directly from your bottom line.

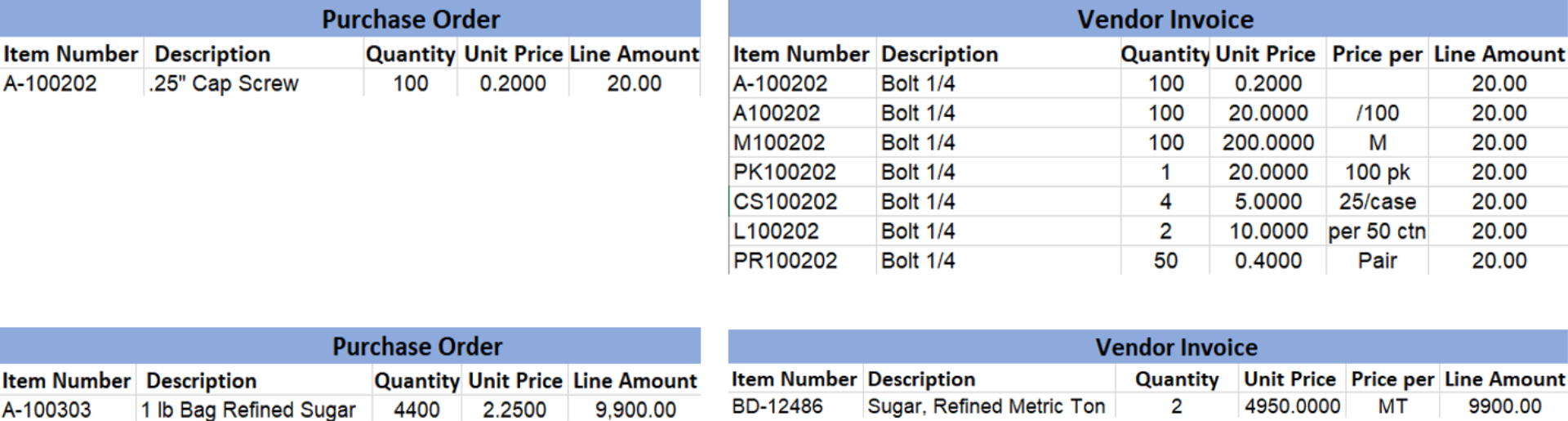

Therefore, if you can reduce the amount of time spent handling exceptions, you can realize significant cost savings. IntelliChief can automatically perform unit of measure and part number conversions to reduce exceptions. For example:

- Lithium grease can be purchased in a drum or a 5-gallon bucket. There are 55 gallons in a drum, which means there are 11 buckets in a single drum. If the invoice and purchase order express this amount (i.e. one drum) in different terms (i.e. one drum vs. eleven buckets) it will result in an exception and require manual intervention to process. IntelliChief utilizes a cross-reference matrix to automate these conversions, eliminating the need for manual approval.

- Steel is often purchased in coils while copper tubing is more commonly purchased by the 20-foot section. Similarly, steel pipe is regularly purchased in 44-foot rail lengths but used by the inch or square inch. When suppliers and purchasers have different expectations about how a material will be utilized, it can lead to unit of measure normalization issues. The final product is ultimately the same, but your AP processors can’t be certain without checking manually. IntelliChief eases the burden of this complicated process by handling the conversions for you and eliminating this step altogether.

Issue #4: Lack of Support for Workflow Automation

By addressing the above concerns with an industry-leading ECM solution like IntelliChief, your business can take advantage of faster processing times and fewer exceptions. It allows businesses to accelerate invoice or customer purchase order processing by eliminating manual intervention and automating your workflow. Even complex matching procedures, such as those involving blanket POs, are no problem for IntelliChief.

As soon as your information enters the system, a 2-, 3-, or 4-way match is performed automatically. With normalization and cross-referencing, the number of transactions that require manual intervention is reduced even further. IntelliChief Capture Enterprise users can even unlock the ability to use straight-through processing, which allows invoices to be processed without any manual entry or intervention from the beginning. As the statistics below prove, the leap in productivity is nothing short of alarming:

Without Normalization/Cross-Reference

- 260 Total Invoices

- 141 Processed Straight Through

- 119 Required Manual Intervention

- 54% Straight to Voucher

With Normalization and Cross-Reference

- 260 Total Invoices

- 254 Processed Straight Through

- 6 Required Manual Intervention

- 97% Straight to Voucher

With IntelliChief, you can reduce the burden of exception handling on your AP team, reach unprecedented processing speeds, and decrease the number of errors in your process by a wide margin. Even when your team is out of the office or unavailable, IntelliChief continues to process transactions in real-time from start to finish.

Overcome Your Accounts Payable Challenges With IntelliChief

There are many benefits for businesses that rely on 3-way matching, including stronger supplier relationships, increased profitability, and superior preparedness for financial audits. However, businesses that don’t automate this process are often overwhelmed with the time- and labor-intensive nature of manually performing 3-way matches. To scale this process as you grow your business, automation is critical. With IntelliChief, there’s no limit to how many documents you can process — even when the office is closed — thanks to robust automation capabilities that learn (and master) your business-critical processes.