In an increasingly technology-dependent world, change is always on the horizon. Your organization has spent years, possibly even decades, working diligently to achieve success. Your people, processes, and customers are a direct result of your organization’s ability to adapt and thrive, but when the playing field is no longer level, it’s time to innovate before you dissipate.

For enterprise-level businesses, keeping pace with innovation is a constant challenge. By ignoring innovation, you only prolong the inevitable. By making rash, uninformed decisions, you shift your company in a dangerous trajectory. The most obvious example is enterprise software, including:

While these technologies have the potential to give your company a distinct competitive advantage in terms of security, accuracy, speed, and cost, finding the right solution takes input and collaboration from a variety of key decision-makers. Who should you include in the enterprise software selection process? It depends on your business, core technology, and objectives. This article provides several insightful tips to help you form a team that will lead you towards the best enterprise software solution to address your specific needs.

Consider This Before You Begin the Enterprise Software Selection Process

It takes time to find the ideal enterprise software vendor for your business. The vetting process can be long and costly, which means establishing clear objectives early on is essential for reducing the cost of your enterprise software project. The vetting process typically involves between three and ten vendors, which means the more vendors you reach out to, the longer and more costly your selection process will be.

Internally, your organization needs to set rules for performing due diligence, vetting qualifications, rejecting poor matches, and, ultimately, defining its shortlist. You don’t want ten vendors on your shortlist. Two is ideal. Three is manageable. But anything beyond that can make the final selection process harder than it needs to be.

Calculating the Cost of Selection

The enterprise software selection process can take anywhere from three to eighteen months. The faster you can pull together your team and start vetting vendors, the smaller the hit to your bottom line. According to the Supply Chain Coalition, it takes “up to 300 hours/person by a team of up to 20 key individuals” to select enterprise software for your business. But with the right team (and helpful vendors), you can cut down this number drastically. They estimate that the cost of selection, on average, equals $900,000. Here’s how they reached this number:

Company burdened rate ($150/hour) x 300 hours x 20 employees = $900,000

And that’s before you get any benefit from your new system. Over the last decade, we’ve implemented enterprise software, such as ECM, AP Automation, and Sales Order Automation, for hundreds of customers. We’ve discussed this statistic with them, and, frankly, the cost of selection has never been calculated anywhere near this figure.

Certainly, this figure could account for the worst-case scenario, but we believe that transparent collaboration is the key to accelerating your project and reducing the cost to implement. You want to recoup your investment as quickly as possible, which is why we’ve made it our goal to help businesses generate 100 percent ROI within the first 12-18 months of implementation.

If you want to learn more about how companies like yours have handled the selection process, our team is happy to walk you through some case studies from past customers that are already using IntelliChief. Now, it’s time to answer the titular question:

Who Should You Include in the Enterprise Software Selection Process?

CEO

The term “CEO” is used rather loosely these days. Investopedia defines a Chief Executive Officer as “the highest-ranking executive in a company, whose primary responsibilities include making major corporate decisions, managing the overall operations and resources of a company, acting as the main point of communication between the board of directors (the board) and corporate operations and being the public face of the company.”

In most companies, high-dollar investments must typically be approved by the CEO. We recommend getting project approval from your company’s CEO before you start the selection process, then looping back around in the later stages of your search to update them accordingly and provide additional knowledge. You must provide a clear rationale for the project, the estimated cost to implement, and the projected time it will take to recoup the investment as well as future projections for cost savings and operational improvements.

It’s unlikely the CEO will be involved throughout every step of the selection process, but they need to be convinced if you want them to provide the proverbial thumbs up or down at important junctions along the way.

Other C-Level Executives to Include in the Selection Process

In addition to the CEO, you should also consider the following C-level executives when shopping for enterprise software.

CFO

As the head of your Finance department, the Chief Financial Officer oversees financial operations, budgeting, and financial reporting. When shopping enterprise software, the CFO is a powerful ally that can help you convey value to the CEO and accelerate the project timeline. Among the members of your team, they also have the most to gain. Enterprise software is highly effective for reducing costs across all areas of your organization — a benefit your CFO will recognize immediately.

CIO

The Chief Information Officer takes the lead in matters concerning information technology (IT) and implementation. This technical role is responsible for ensuring the smooth rollout of any new technologies in your organization. However, their job doesn’t exclusively involve overseeing hardware, software, and data for the C-suite. They are also tasked with researching potentially lucrative technologies, building use cases, and providing value propositions. In most implementations, the CIO plays a prominent role because they combine the technical know-how of IT with the high-level insights of the C-suite.

Recommended Solutions: Enterprise Content Management, Accounts Payable Automation, Sales Order Automation, HR Automation, and Document Retention.

President/Vice President

Sometimes, the CEO is too busy or unavailable to greenlight a new project. As the second in command, the President (or even the Vice President) can be an effective partner in navigating the software selection process. Similar to the CEO, they have high-level knowledge of your organization’s needs and a strong understanding of what must be done to succeed in an increasingly competitive marketplace.

Some companies have a single President, while others have several Vice Presidents overseeing various departments. Determining who you should turn to (or who should take it upon themselves to initiate an enterprise software project) depends on the hierarchical structure of your company. While these positions most commonly deal with logistics, business operations, and policy, they can also serve as the glue between various managers and decision-makers. They can help you determine which type of enterprise software will have the most significant benefit by examining operational weaknesses, inefficient business processes, and detrimental cost centers.

Recommended Solutions: Enterprise Content Management, Process Automation, and Platform Services.

Operations Manager

The operations manager, also referred to as chief operating officer or COO, oversees various high-level HR-related duties, including:

- Scouting and attracting qualified talent

- Establishing rigorous training standards

- Refining the hiring process

- Analyzing organization processes and recommending improvements

- Enhancing workforce quality, productivity, and efficiency

Implementing enterprise software, whether in Human Resources or any other department in your organization, will affect your employees directly by altering the way they perform their jobs. While these changes are almost always positive, they are changes, and employees often resist changes to the status quo.

The operations manager can help make this transition a smooth experience for everyone by providing their expertise and representing the sentiment of current and future employees. They can also refine hiring processes to account for new technology.

Whether your organization is looking to automate HR-based processes or increase efficiency across multiple departments, the operations manager can provide an employee-first perspective to ensure that your enterprise software implementation makes work more enjoyable for all.

Recommended Solutions: HR Automation, Process Automation, and Document Retention.

Production Manager

The production manager plays a vital role in any organization that creates and distributes products. From scheduling to budgeting and meeting deadlines, the production manager has an inside track on the functions that allow your business to satisfy commitments to customers.

How does enterprise software factor into your production line? This is an important question that you will need to address at some point during the enterprise software selection process. The production manager can help you answer it.

For example, if you are shopping for Sales Order Automation, your production manager can help you understand the effect faster order processing and clearance will have on your production needs. When you get paid faster, you can complete orders more quickly, but what effect does that have on production? There’s a good chance that you will need to produce more products to satisfy faster order turnaround.

Recommended Solutions: Sales Order Automation, Document Management for Manufacturing, and Accounts Receivable Automation.

Warehouse/Shipping Manager

According to TalentLyft, warehouse managers (or shipping managers) are responsible for an array of important tasks, including “packing, verifying content for shipping, receiving packages, [and] ordering supplies.”

However, today’s shipping managers are also responsible for using software to optimize distribution processes, managing documents (i.e., advanced shipping notices, pick slips, bills of lading, and more), and directing packages from start to finish.

Depending on your enterprise software solution, any number of these processes can be streamlined or automated, which means including your warehouse/shipping manager in your search will help you identify a solution that meets your requirements from both operations and cost savings perspectives.

Recommended Solutions: Sales Order Automation, Document Management for Distribution, Document Management for Manufacturing, Enterprise Analytics, and Workflow Automation.

Accounts Payable Manager

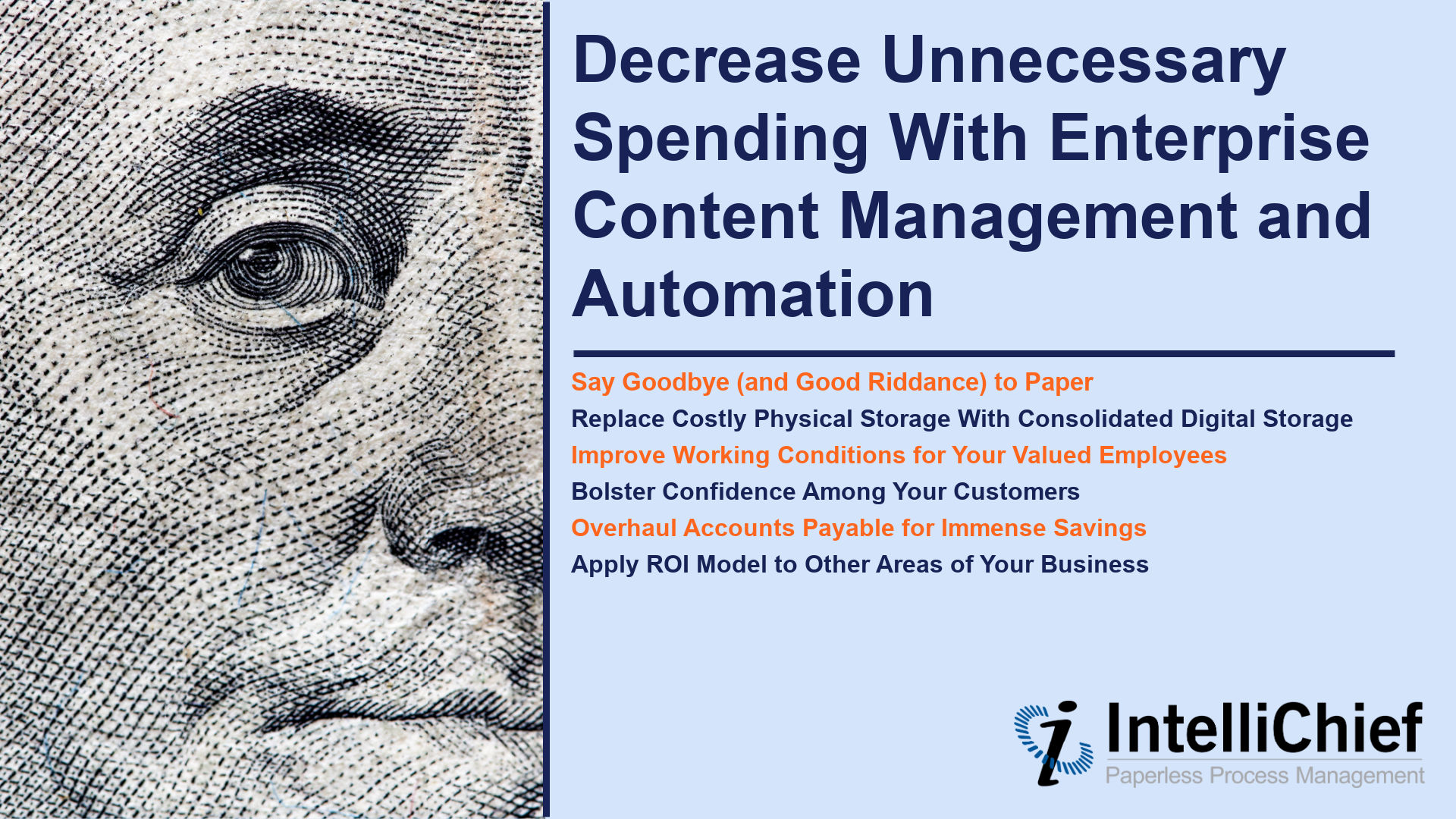

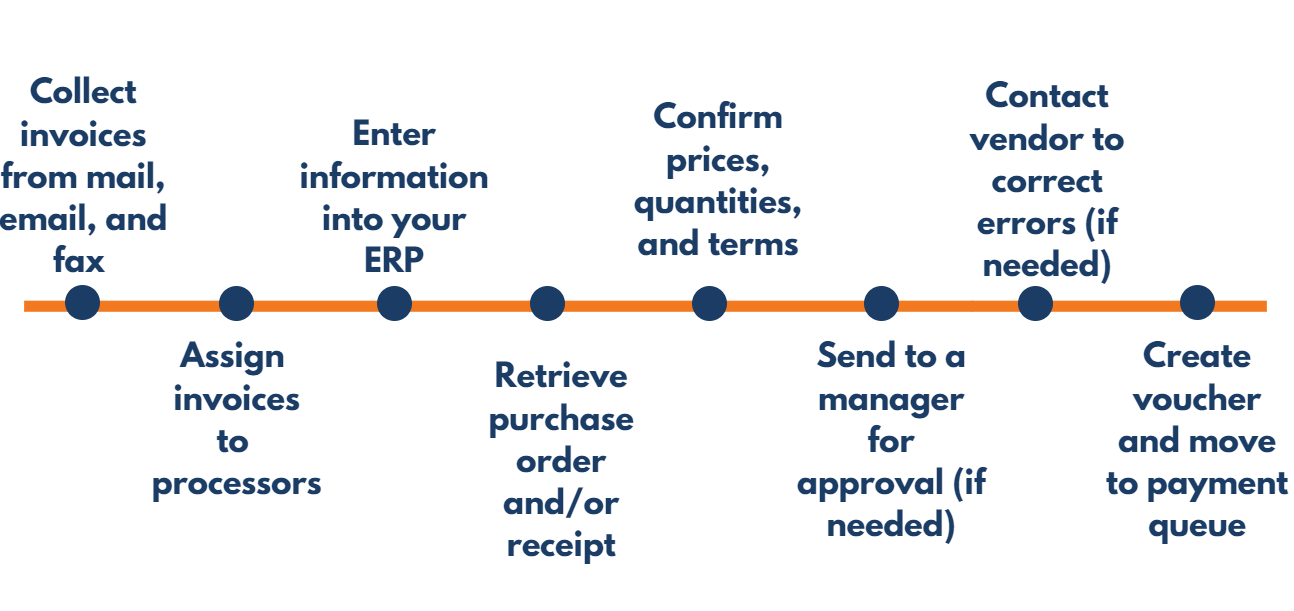

One of the fastest ways to recoup your initial investment when purchasing enterprise software is by starting in Accounts Payable. If your organization is still performing AP tasks “the old way,” it will benefit immensely from Accounts Payable Automation.

AP Automation helps businesses reduce invoice processing costs, eliminate late fees, and capture more early payment discounts. It’s the perfect starting point for any enterprise software implementation because it demonstrates lightning-fast ROI and significant operational improvements. Once you see the benefits of AP Automation, it’s only a matter of time before you expand your solution to other departments — if your solution is designed for the enterprise and can be utilized for multiple applications.

Your Accounts Payable Manager is an integral part of any software selection committee, providing the technical expertise of your specific AP processes that will allow your vendor to automate your processes in a way that matches the way you currently do business (while refining these processes and making them faster and more efficient).

When implemented by a proven vendor with a penchant for AP Automation success, your AP manager’s job becomes much easier. AP Automation streamlines invoice processing, voucher creation, records management, and reporting.

Recommended Solutions: Accounts Payable Automation and Enterprise Content Management.

Line Supervisors

Line supervisors oversee work performed on the line, manage schedules, and monitor quality control. Career Trend describes line supervisors as the “eyes and ears on the line during operations.”

Although line supervisors do not perform high-level management tasks, they can provide the most granular insights into your specific processes. When mapping processes for process automation, talking to your line supervisors can ensure that nothing falls between the cracks. This is important because even minor tasks can throw off your automation implementation when unaccounted for. Plus, they will have a more complete understanding of undocumented tasks and tribal knowledge associated with the particular line they are supervising.

Recommended Solutions: Determined on a case-by-case basis.

Outside Consultants

Forming a selection committee with members of your organization is a surefire way to ensure that your selection process is productive; however, there’s no denying the fact that the solution you need may not be one that you’re familiar with. For this reason, many businesses seek assistance from consultants outside of their organization. Outside consultants are helpful for a number of reasons, including:

- Experience dealing with customers that match your business profile

- Expertise on the subject of enterprise software as well as the various types of software that can be utilized to solve your unique problems

- Connections within the enterprise software industry for potential discounts

- Taking point during the selection process to weed out vendors that are only looking for a sale

- Impartiality during the selection process

- Familiarity with your existing core technology

- Industry-specific or ERP-specific knowledge

Recommended Solutions: Determined on a case-by-case basis.

Account Executives (From Vendor Shortlist)

Once you have created a shortlist of vendors you are interested in discussing your project with, establish a point of contact at each solution provider. Are they trying to sell you their product? Yes. But in order to do so, they need to answer all of your questions and gain your confidence. In other words, you have all the leverage during the selection process.

Here’s an insider tip: the vendors on your shortlist are expecting you to be in talks with other providers. Use this to your advantage. Compare and contrast their offerings against the others on your shortlist. It’s a good idea to be transparent about the other vendors you’re considering as this can help you discover which ones are being substantive with their claims and which ones are only blowing smoke.

Ultimately, it’s up to you to decide for yourself which vendor has the right solution for your business, but it’s impossible to distinguish between the good and the bad without talking directly to an account executive from each contender. Here are some questions to consider as you talk to vendors:

- Does the solution integrate with my ERP system?

- If so, does the integration provide real-time updates?

- Will I have to change my business processes?

- Is the interface user-friendly?

- What features are available to improve straight-through processing rates?

- Does the solution permit remote work capabilities?

- Is the solution able to be audited?

- Does the solution feature analytics for reporting?

- Can the solution be expanded to other departments?

- What else is included beyond the software itself?

- How is training handled?

- What makes this solution more suitable than the others on my shortlist?

- How can we verify ROI before making a significant investment?

By asking these questions (and others), you can start to whittle down your shortlist from the recommended three vendors to your chosen enterprise software solution.

Recommended Solutions: Determined on a case-by-case basis.

You’ve Formed Your Enterprise Software Selection Committee. What’s Next?

Now that you’ve assembled a diverse, knowledgeable team of experts from inside and (potentially) outside your business, it’s time to get to work. The longer you wait to implement a game-changing solution, the higher the opportunity cost of remaining the same. Businesses often fail to recognize the detrimental effect of existing inefficiencies that have been baked into your processes for years or decades — but this is the very reason why waiting to get started only hurts your bottom line. Fortunately, there are several ways to get started, including:

For more information on identifying the right enterprise software solution for your unique business needs, contact us today. Our experts are standing by to help your break down your goals and requirements. One quick chat with an expert can potentially save you hours of wasted time by ensuring that your search is pointed in the right direction from the start.