The 5 Accounts Payable KPIs Your Business Should Be Measuring

Key performance indicators (KPIs) are measurement values that help your organization understand how effectively it conducts business on a day-to-day basis. Across your organization, KPIs can be used to target areas of inefficiency and propose solutions to address them. In certain departments, like Accounts Payable, measuring KPIs and utilizing them to inform your corporate decision-making can have a tremendous effect on your bottom line. Unfortunately, Accounts Payable KPIs are notoriously difficult to track.

Although tracking Accounts Payable KPIs is a challenge, you shouldn’t give up! They play a critical role in helping your organization achieve its most crucial business objectives —all you need is the right tools and expertise to get the job done.

What Are Accounts Payable KPIs?

Accounts Payable KPIs are a direct reflection of your invoice processing procedures. They help tell the story of who, what, when, where, why, and how in your AP department. For example:

- Who processes the most invoices each day?

- What suppliers take the longest to reconcile?

- When are invoices received?

- Where are invoices being held for longer than necessary?

- Why is AP failing to secure early payment discounts?

- How many duplicate invoices are being erroneously paid for?

Below, we’ll cover the five Accounts Payable KPIs your business should be measuring, but first, it’s important to understand how you can track these KPIs. As Peter Drucker famously said, “What gets measured gets managed.” But doing so can be easier said than done.

Of course, you can review balance sheets and dig through your system of record to try and piece together KPIs — but there’s an easier way. With automation, tracking Accounts Payable KPIs is as simple as logging into your workstation and reviewing an AP KPI dashboard.

How Does Automation Affect Accounts Payable KPIs?

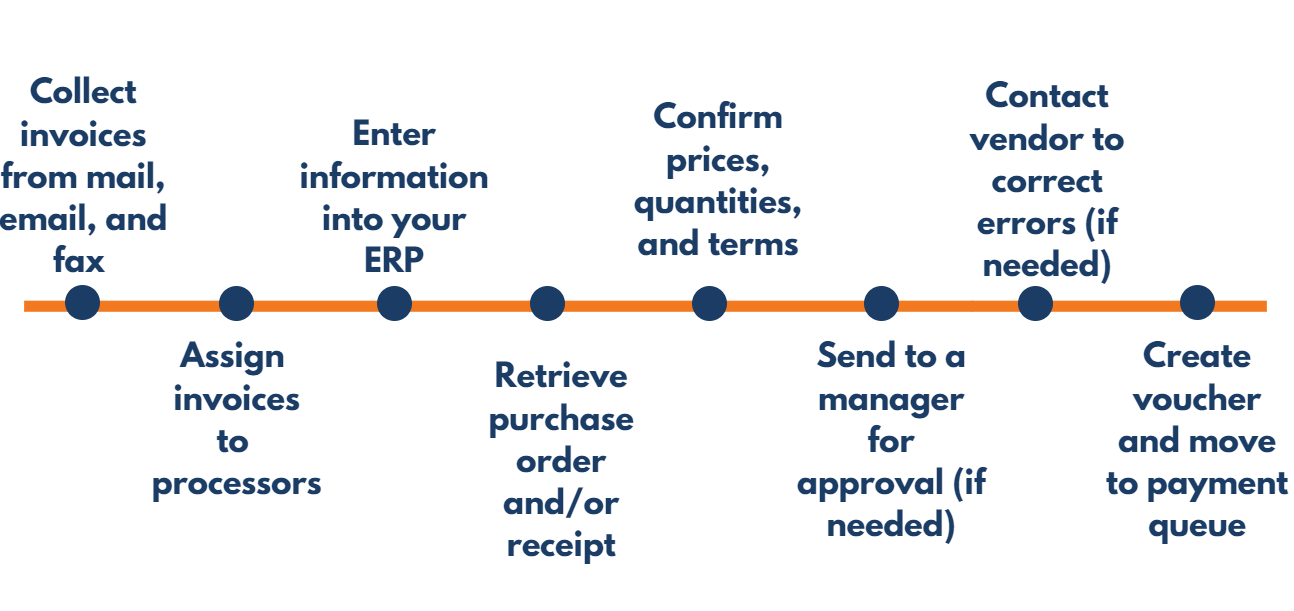

When you think about Accounts Payable Automation, you probably imagine invoices being captured, automatically entered into your ERP, coded, and reconciled by intelligent software. From a functional perspective, these are some of the core capabilities of any solution worth its salt, but underneath your busy workflows lays another important feature — recording data related to all of these processes and relaying them to your administrators in an intuitive and organized fashion.

Just think, if you wanted to track how long invoices took to process on average in your organization, it would require each and every employee to time every stage of the invoice processing cycle. This information would then need to be coded or otherwise attributed to a specific invoice across multiple stages of processing and, finally, combined to give you the full summation of your invoice processing time. This process would be required for every invoice that enters your organization. Depending on your process, it could require multiple employees to collaborate to provide the necessary data to understand how long the average invoice takes to approve. Needless to say, this would have a detrimental effect on the exact KPI you’re trying to measure, adding extraneous work to an already highly manual and cumbersome process.

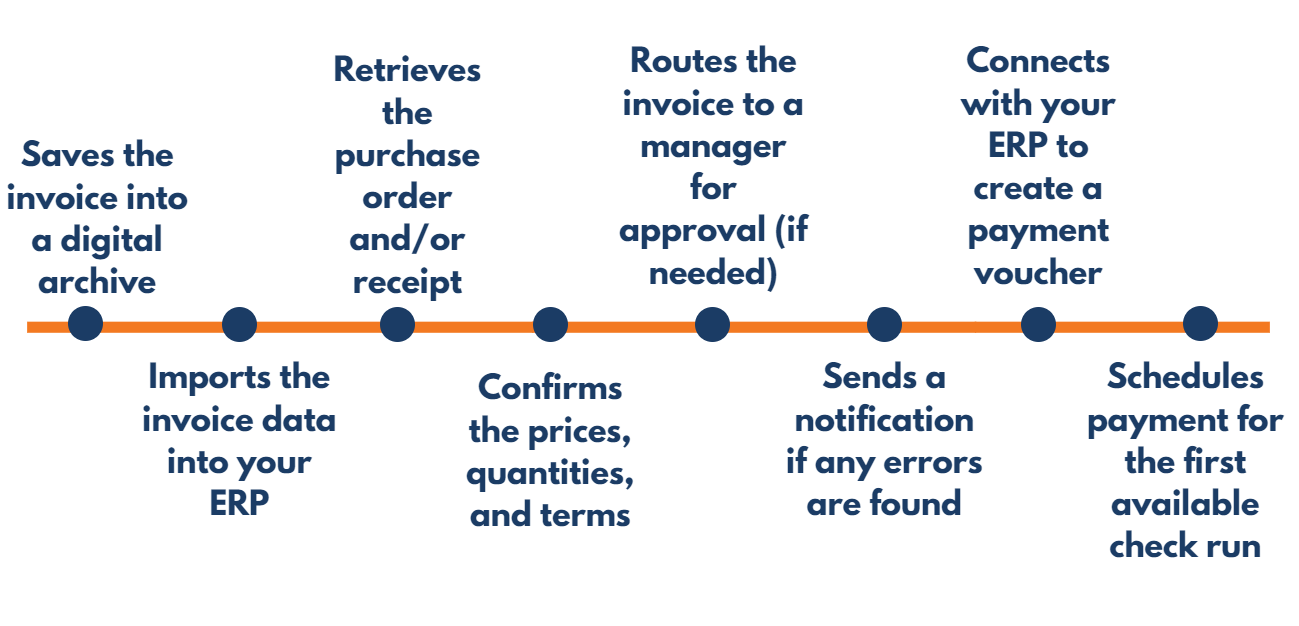

With Accounts Payable Automation, this data is collected automatically. Any information you want to collect to review your process is made available without any additional work needed. Therefore, your process would not only get faster but increase visibility and provide valuable insights to help your organization become more efficient while saving money. When recalling this information, it would already be compiled into graphs and charts that accurately reflect the KPIs you want to review and analyze. It’s a win-win for your AP department and C-level executives.

The value of this capability can’t be overstated. However, once you harness this power, you need to be mindful of how you use it. The following five Accounts Payable KPI examples highlight why this information is critical to all organizations.

Top 5 Accounts Payable KPI Examples

Let’s break down some examples of important Accounts Payable KPIs your business can track with AP Automation.

1. Overall Cost Per Invoice Processed

When measuring KPIs, you want to improve your understanding of how your business is operating and how much it is costing you. Determining your overall cost per invoice processed will help you do just that. This KPI is defined as the total cost of processing an invoice, including:

- Labor Costs

- Infrastructure Costs

- Office Supply Costs

- Postage Fees and Services

When you compare your organization’s cost per invoice against industry benchmarks, you can get a clear view of where you stand currently and how much further you have to go to remain competitive with industry leaders.

According to the Aberdeen Group, the average cost to process an invoice manually is $16.67 whereas the average cost to process an invoice with AP Automation is a mere $3.63. By monitoring this KPI, you can ensure that your cost per invoice is trending towards the lower end of this value. With the right solution, you may even be able to surpass this average. For example, the average IntelliChief customer reduces their cost per invoice by 75 percent.

2. Average Time Per Invoice Processed

On average, companies with a manual AP process take 16.3 days to process an invoice. This helps to explain why these companies tend to miss out on early payment discount opportunities and pay more late payment fees.

On the other hand, companies with AP Automation take an average of 2.9 days to process an invoice. That’s an 82.2 percent decrease in the amount of time it takes to complete the same job, which also affords these companies 82.2 percent more time to focus on high-level, strategic tasks that can’t be automated. Longer than average invoice processing times are oftentimes the result of process inefficiencies, such as needlessly complicated workflows, incorrect invoice coding, and delayed routing or approvals. Automation addresses these issues to accelerate the procure-to-pay (P2P) cycle.

3. Average Percent of Invoice Exceptions

Invoice exceptions cause issues even in the most high-functioning AP departments. They are known to create manual data entry bottlenecks and contribute to dysfunction whenever they appear in the invoice processing queue.

Common invoice exceptions include discrepancies (i.e., wrong supplier codes), incorrect or missing POs, non-PO invoices, and special charges (i.e., tax and freight) that must be added to the invoice later in the P2P cycle. Understanding your company’s average percent of invoice exceptions can help you reallocate resources to prepare accordingly.

4. Number of Invoices Processed Straight-Through Vs. Manually

Once an organization has implemented AP Automation, they can use automation-specific KPIs to gauge performance improvements and obtain a better understanding of how their process has evolved. When it comes to AP Automation, straight-through (or touchless) processing refers to invoices that are processed from start to finish without any human intervention. These “perfect” invoices can be received, reviewed, and approved faster than any other type of invoice.

It’s a true game-changer for organizations that seek to improve efficiency and accuracy while processing invoices at the lowest possible cost. The more invoices that your organization can automate “straight-through” the more significant the impact on your bottom line.

5. Percent Reduction in Received-Not-Vouchered Invoices

Received-not-vouchered (RNV) is a status that occurs when a PO is received and inventory or a non-inventory general ledger expense account is debited. At the same time, a matching open amount is created on another table. Once the vendor’s invoice has arrived, all tables should be reconciled. However, it must often be done manually. It’s a somewhat common issue, but it can be a headache for your AP department.

In fact, Toolbox hosted an interview with Susan Stooksberry of JDEtips to discuss methods for dealing with RNV invoices. With AP Automation, reducing the number of RNV invoices that must be processed manually is easy because automation performs many of the actions that help reconcile these tricky invoices. By reducing the percentage of RNV invoices that must be processed manually, your AP department saves time.

How to Measure KPIs for Invoice Processing

As we mentioned above, the best way to measure KPIs for invoice processing is to let an AP Automation solution handle the work for you. With automation, there’s no need to maintain spreadsheets, track time, or record data manually — data recording takes place around the clock and tracks every single action in real-time. With the right solution, your KPIs are never more than a few clicks away. You can access all KPI data from your Accounts Payable KPI dashboard, where your chosen KPIs can be viewed on charts, graphs, tables, or other visual representations to make KPI analysis simple and effective.

Building Your Accounts Payable KPI Dashboard

To build out your Accounts Payable KPI dashboard, contact your vendor to see if one of their systems administrators can assist you. Some solutions utilize simple interfaces to make programming your dashboard a breeze, whereas others will require a specialist. Depending on the KPIs you wish to track, and the level of customization required to track them, it might be best to let your vendor handle the bulk of this work. However, some solutions (IntelliChief included) feature “ready-made” dashboards to help you track important KPIs, such as the five we covered in this article.

Are You Ready to Start Measuring?

The sooner you start measuring KPIs for invoice processing, the sooner you can refine your AP process and work smarter, not harder. Start contacting AP Automation vendors today to see how your organization can become faster, leaner, and more cost-effective by automating invoice processing and analyzing auto-generated AP data. By this time next year, you could potentially reduce your AP costs by 70 percent or more, allowing your business to provide for strategic initiatives that have been swept under the rug for far too long.