AP Automation Cost Savings

You know that Accounts Payable automation cost savings can make a major impact on your business – but do you know just how major?

Let’s talk numbers.

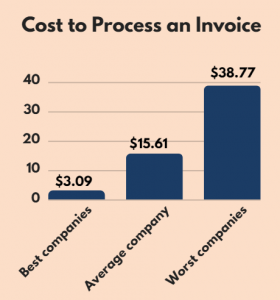

On average, companies with a manual, paper-based AP environment require 14.6 days to process a supplier’s invoice. It cost them $16.91 to do so.

In contrast:

Companies that use AP automation can process an invoice in just 2.9 days — at a mere $3.47 per invoice.

The Hard Dollar and Soft Dollar Savings of Accounts Payable Automation

Here are the quantifying elements.

When you eliminate manual invoice processing, there are several things that directly reduce your expenses. It’s often a combination of:

- Better business processes

- High-ROI technologies

- Simplified internal policies

Though hard dollar savings are easier to calculate, don’t ignore the soft dollars. Soft dollar savings help you reduce costs through:

- More strategically allocated labor resources

- Greater efficiency

- Productivity gains

- More actionable strategic information

- Proactive compliance

- A more rewarding work environment/decreased staff turnover

These savings (and competitive advantages) extend to many different activities throughout your organization. Here’s a breakdown:

Staff Resources, Time, and Cost Involved with Manual Invoice Processing

Here are calculations that can help you quantify the true cost of AP processing:

Task # of People % of Time Salary Total Cost

Opening & Sorting Invoices 1 Person 20% $45,000 $9,000

If it takes 1 person 20% of their time to open and sort incoming invoices mailed, emailed (then printed), and faxed, and they are being paid $45,000 annually, the cost to open and sort is $9,000.

Task # of People % of Time Salary Total Cost

Manually Keying Invoices 2 People 60% $45,000 $54,000

If it takes 2 people 60% of their time to key invoices into ERP and accounting systems, with an annual salary of $45,000 each, the cost to manually enter invoice information is $54,000.

Task # of People % of Time Salary Total Cost

Filing Paper Invoices 1 Person 40% $35,000 $14,000

If it takes 1 person 40% of their time to file paid invoices into the paper filing storage onsite, and their compensation’s $35,000 annually, the cost to manual invoice filing is $14,000.

The Total Bill: $77,000

Add these costs together, and this small Accounts Payable department costs a company $77,000 in a year. And these costs increase rapidly as more transactions are processed (and more resources are utilized)

More AP Cost Statistics

Other things you should know:

- Companies that process invoices manually report an error rate of 4 percent.

- 62 percent of invoice processing costs represent staff labor.

- Only 30 percent of companies use automatic capture to help with AP invoice processing.

- 50 percent of early payment discounts go unobtained, as companies struggle to execute payment in time.

- Only 32 percent of companies monitor and analyze the performance of their AP department.

One final takeaway – and perhaps the most important: Accounts Payable automation has the potential to reduce processing costs by as much as 80 percent.

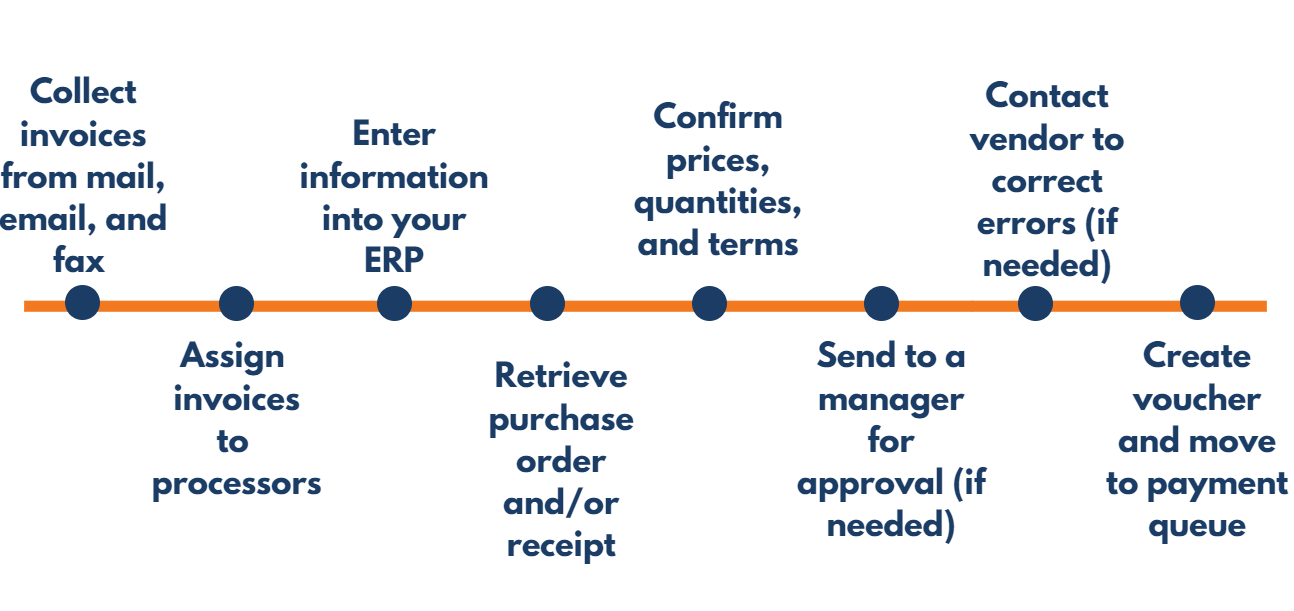

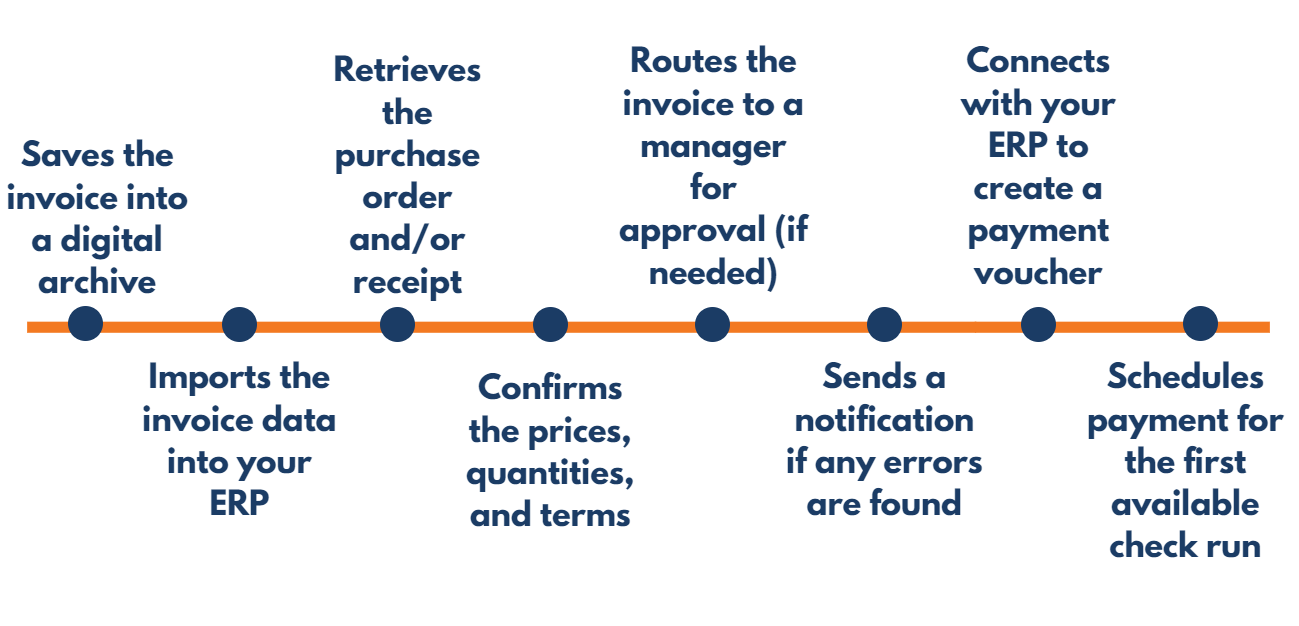

Processing an invoice takes quite a bit of time – and therefore, quite a bit of money. For most organizations, a salaried AP employee has to collect, sort, and distribute paper invoices, bring them to the appropriate individuals for processing or approval, and key them into an ERP. These are all routine, low-value tasks, but they must be completed.

Processing an invoice takes quite a bit of time – and therefore, quite a bit of money. For most organizations, a salaried AP employee has to collect, sort, and distribute paper invoices, bring them to the appropriate individuals for processing or approval, and key them into an ERP. These are all routine, low-value tasks, but they must be completed.